Martin’s Management Accounting Textbook: Chapter 6 Leave a comment

To simplify the example, assume that the first stage cost allocations have already been performed using the reciprocal method as indicated in Exhibit 6-7, thus we areready to choose a method for the Stage II allocations. Since it is not clear how these allocations should be performed to obtain more accurate product costs, wewill examine three possible alternative methods. The dual rate or flexible budget method refers to using separate rates, or allocations for fixed and variable service costs.

a) Subjectivity in allocation basis:

- Unfortunately, this method is also criticized because it tends to recognize income before the time of sale.Resolving this conflict leads back to the previous method, i.e., go one step further and subtract an average profit margin.

- As indicated in Exhibit 6-14, X1 requires a larger proportion of cutting time, while X2 requires a larger proportion ofassembly time.

- Discuss the cost distortions that tend to occur when a plant wide overhead rate is used.10.

- They can be either fixed, like insurance premiums, or variable, like energy usage.

- P1 represents the total costs of the Assembly Department after all service department allocations.

This approach involves allocating the joint costs to products in proportion to these estimated sales values. It provides an alternative to the previous approach when the productscan not be sold at the split-off point, i.e., without further processing. Since this is not likely to be an accurate assumption concerning the values added by the separate joint and after split-off processes, the NRVestimates of values at the split-off point are likely to be misstated. However, if there are no identifiable sales values at the split-off point, this methodseems to provide the next best alternative. To show how a single plant wide overhead rate can distort product costs, assume that the firm in Example 6-1 produces two products, X1 and X2.

Types of Costs

For example, for performance evaluation and motivation purposes, the “fairness and equity” logic is sometimes moreappropriate for common administrative and facility related costs. Examples include top management salaries, internal auditing, company legal and medicalfacilities, advertising designed to promote the company image, public relations and how to file an extension for taxes landscaping around the facility. From the “fairness and equity”perspective, one could argue that these costs should not be allocated at all, or if they are allocated to the various segments of a company, the “ability tobear” logic should be used. This reasoning suggests that only the service department’s variable costs should be charged out.

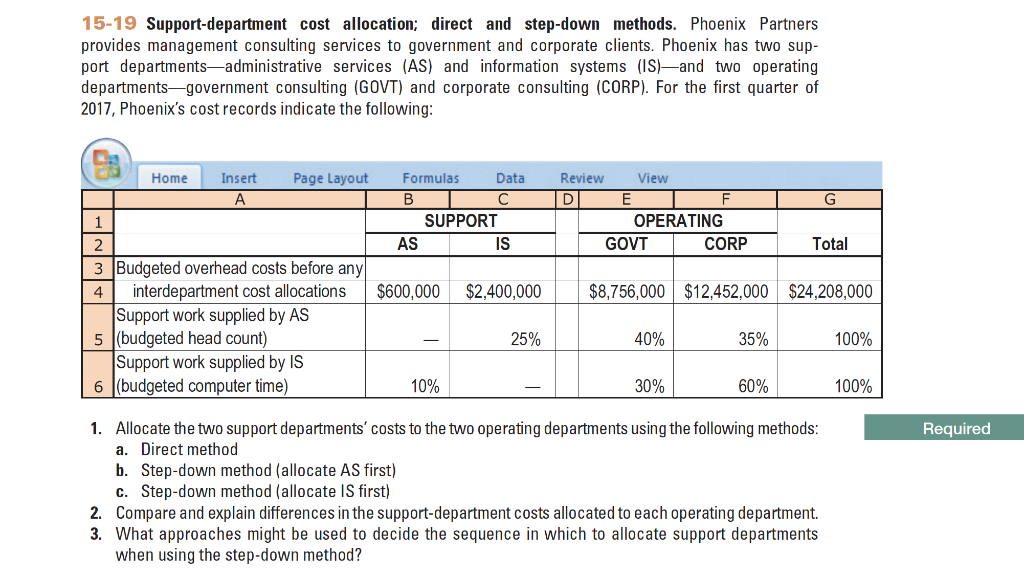

Cost allocation methods

Indirect costs that cannot be easily traced to a specific product or segment, such as rent, utilities, and administrative expenses. How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports.

The service departments and allocation proportions for the direct variable costs appear in the lower part of Table 1. In addition to allocating costs for inventory purposes, management needs accurate cost allocations for a make or buy decision. The company has always generated its’ own electric power since the plant was built in a rather isolated area of the northwest.

Revised income statements are presented in Exhibit 6-19 to underscore this point. The values added beyond the split-off point are $280,000 for productW and $160,000 for product D. (See the note under the table for these calculations.) These values do not change, regardless of the joint costallocation method, although the individual gross profit amounts vary widely across the four methods. Clearly, selling both white and dark fried chicken ismore profitable than selling either product at the point of separation. From the service cost perspective, the differences are more significant. Both the direct and step-down methods understate power costs by $9,585, or approximately 9.6%.

For example, hospitals use sophisticated methods for allocating costs of service departments such as Housekeeping, Patient Admissions, and Medical Records to patient wards and outpatient services, and then to individual patients. Historically, these allocations were important to hospitals because Medicare reimbursement was based on actual costs. A plant wide rate based on either direct labor hours or machine hours would provide the same product costs as separate department rates based on these measurements.b.

These estimates are used todevelop predetermined departmental overhead rates for the Cutting and Assembly departments. As can be seen by adding $105,522 and $134,478, all $240,000 incurred by the service departments are ultimately allocated to the two production departments. The intermediate allocations from service department to service department improve the accuracy of those final allocations.

Instead of wondering about the impact of a decision, you can model it first. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

The step-down method is a cost allocation approach used to assign indirect costs to various segments or products within an organization. It involves a hierarchical allocation of overhead costs, where costs are first assigned to the primary cost pools and then systematically allocated to secondary cost pools in a step-by-step manner. A BI and FP&A platform like Phocas takes this flexibility even further.